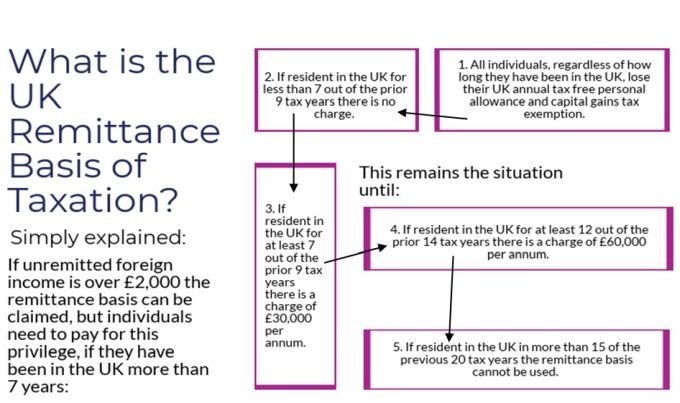

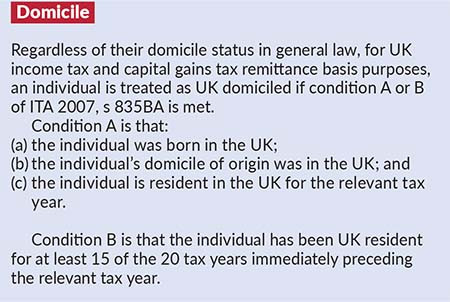

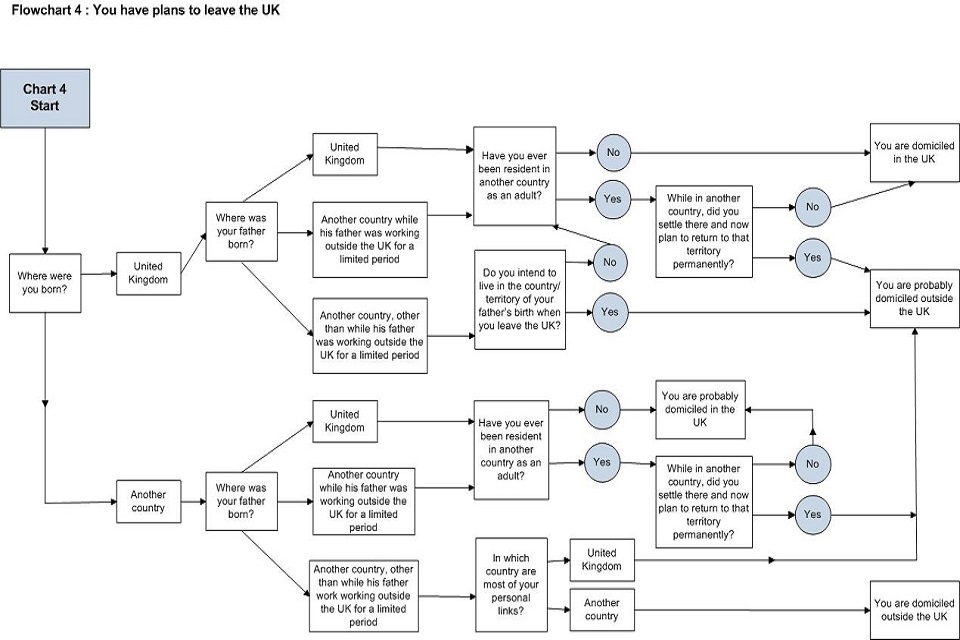

International aspects of personal taxation (for Advanced Taxation - United Kingdom (ATX-UK) (P6)) | ACCA Global

International aspects of personal taxation | P6 Advanced Taxation | ACCA Qualification | Students | ACCA Global

Test Your English - 逃稅tax evasion 是犯法,TYE 不鼓勵犯法行為,但非常鼓勵合法地為自己減輕稅務負擔,所以你需要知道什麼是「居籍」。 ️⚠️你的稅務情況不能三言兩語說清,為了確保你能獲得準確稅務建議,請向專業人士尋求協助,或到

International aspects of personal taxation | P6 Advanced Taxation | ACCA Qualification | Students | ACCA Global

International aspects of personal taxation | P6 Advanced Taxation | ACCA Qualification | Students | ACCA Global