Distribution of loss given default rate. This figure shows the LGDR... | Download Scientific Diagram

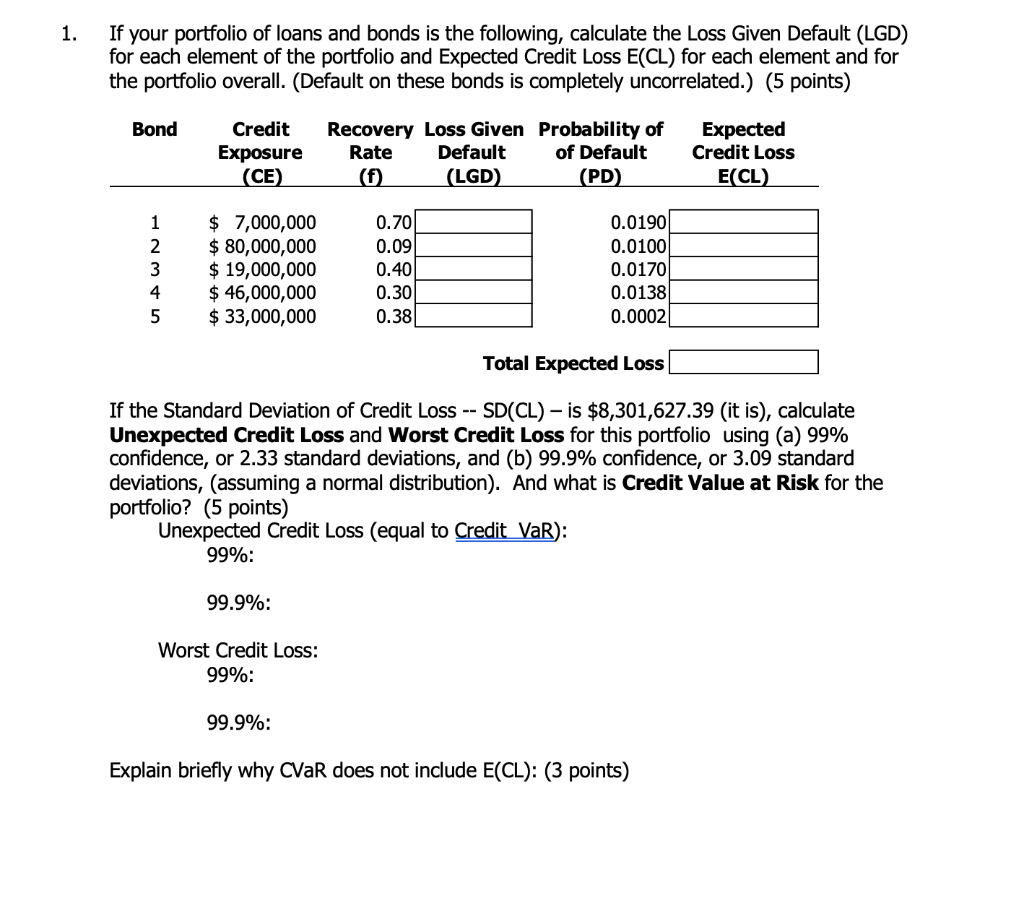

Loss Given Default - Empirical observations and models: A Basel II Ratio for calculation of Expected Losses: Petrov, Ivan: 9783639178081: Amazon.com: Books

![PDF] Econometric approach for Basel II Loss Given Default Estimation : from discount rate to final multivariate model | Semantic Scholar PDF] Econometric approach for Basel II Loss Given Default Estimation : from discount rate to final multivariate model | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/fc954a9ac25c2fd9f2de67b9f89b53aa36742e6c/14-Table3-1.png)

PDF] Econometric approach for Basel II Loss Given Default Estimation : from discount rate to final multivariate model | Semantic Scholar

![PDF] Default Probability and Loss Given Default for Home Equity Loans | Semantic Scholar PDF] Default Probability and Loss Given Default for Home Equity Loans | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/5b7b1abe21d02e902c2da1484a57044f5e906b3e/12-Table3-1.png)

:max_bytes(150000):strip_icc()/what-factors-are-taken-account-quantify-credit-risk.asp_V2-bfcbf24c1f2f42d1ba639fbfb830e67f.png)