The risk and return relationship – part 1 | P4 Advanced Financial Management | ACCA Qualification | Students | ACCA Global

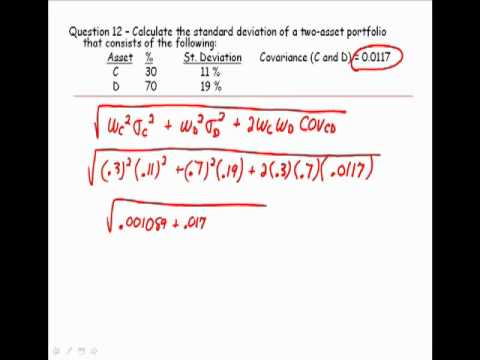

Given a goal for standard deviation of a portfolio, how can I construct a portfolio using market return and a risk free asset? - Quora