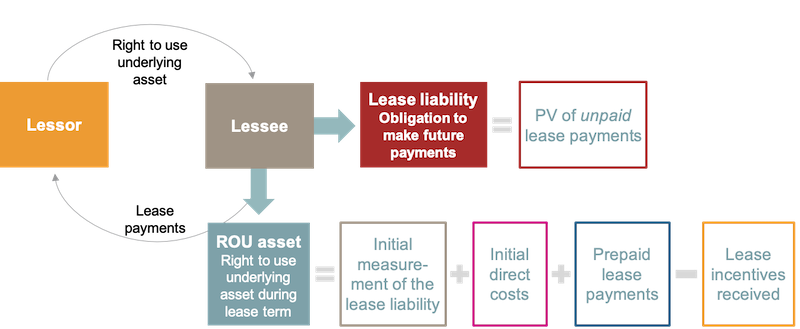

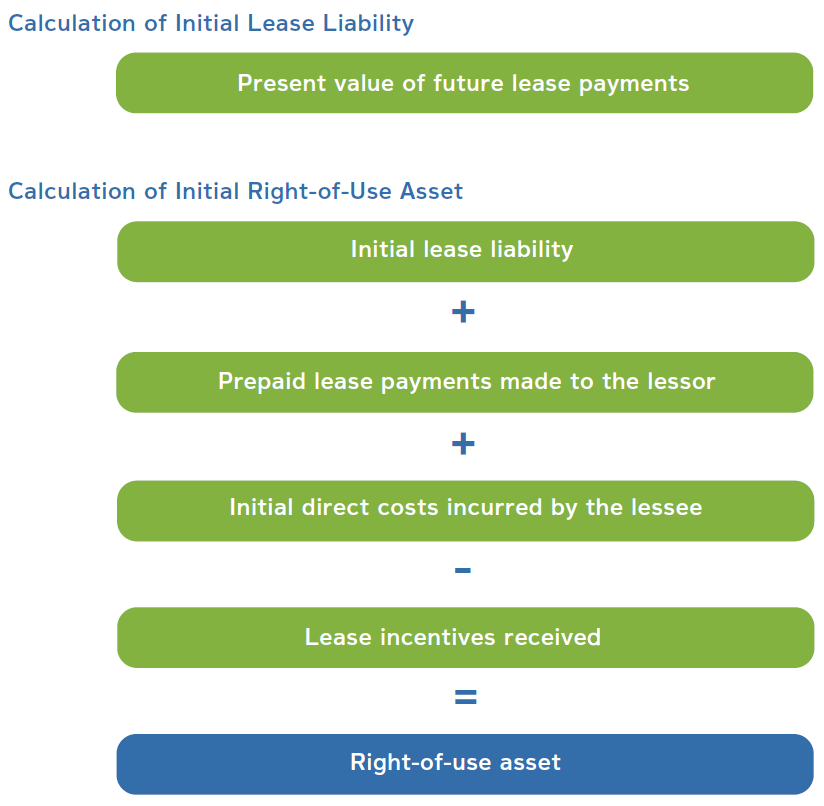

How to Calculate the Lease Liability and Right-of-Use (ROU) Asset for an Operating Lease under ASC 842

How to Calculate the Lease Liability and Right-of-Use (ROU) Asset for an Operating Lease under ASC 842

How the New Lease Standard Could Impact Your Compliance with 4 Common Debt Covenants | Cohen & Company

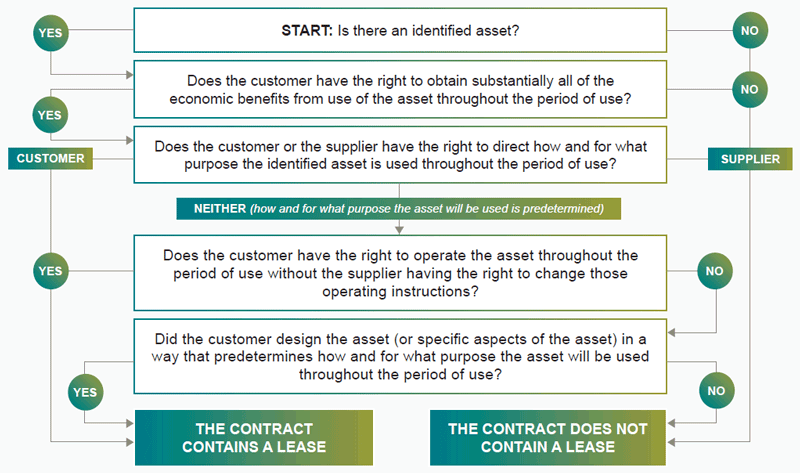

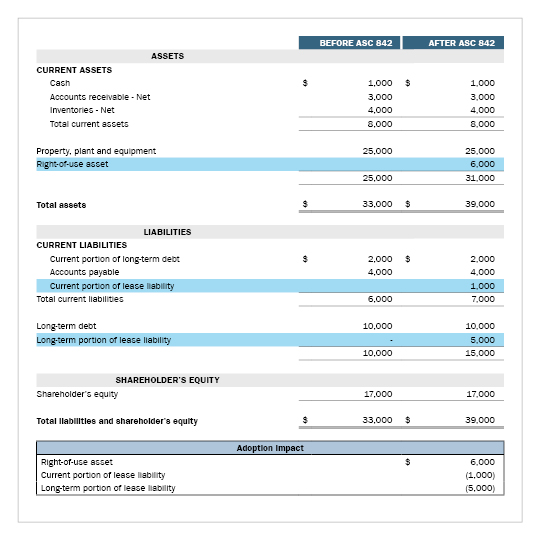

![ASC 842 Balance Sheet Changes, Example, Implementation [2021] | Visual Lease ASC 842 Balance Sheet Changes, Example, Implementation [2021] | Visual Lease](https://visuallease.com/wp-content/uploads/2019/10/ASC-840-vs-ASC-842-Balance-Sheet-Balance-Sheet-Changes-for-ASC-842-Operating-Leases.png)