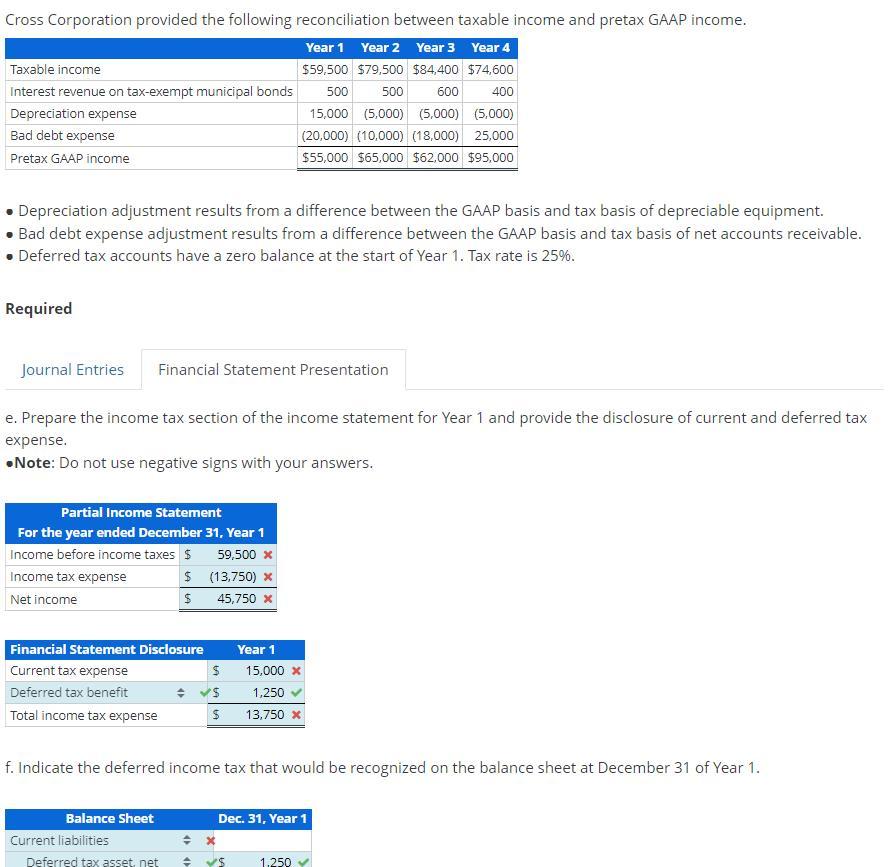

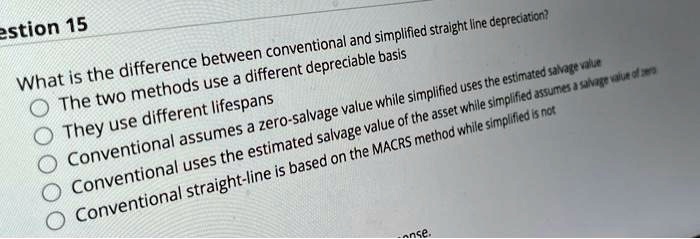

SOLVED: estion 15 deprenaton? and simplified straight Iine conventional : difference between depreciable basis different Jsanale Qla What is the use estm-ated > Jan aeon methods simplified [ luses The two while = '

Solved: How do I enter second year car depreciation (used for business) for a new client? - Intuit Accountants Community

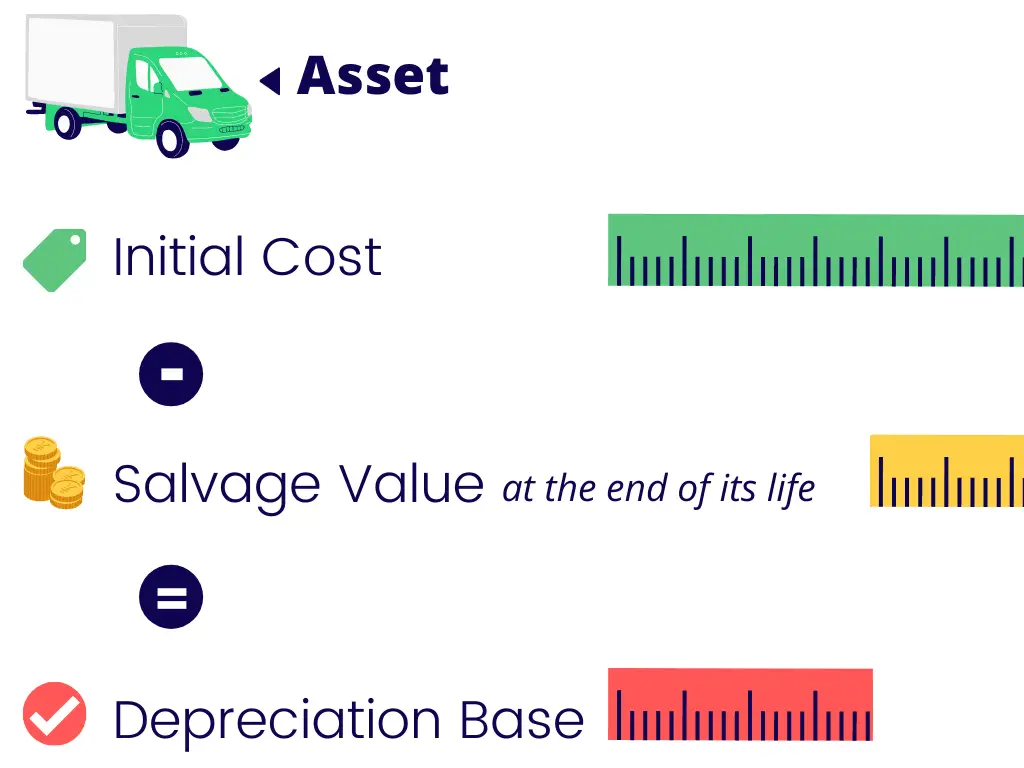

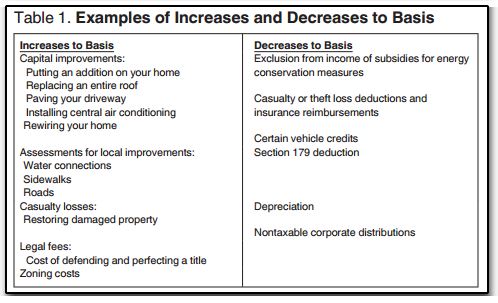

:max_bytes(150000):strip_icc()/BasisValue_Final_4200873-97707377187e4d319618c42a099ca055.png)