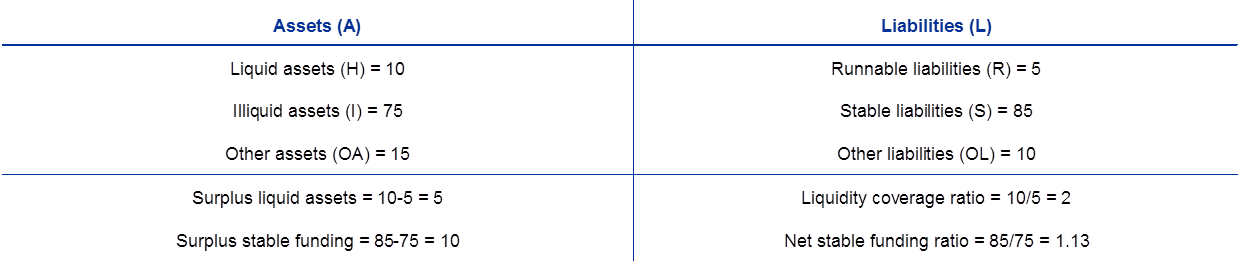

Sidi C #0Doubt on Twitter: "The higher their "high Liq asset" in their portfolio, the better the bank is positioned! "The Liquidity Coverage Ratio (LCR) requires banks to have sufficient high-quality liquid

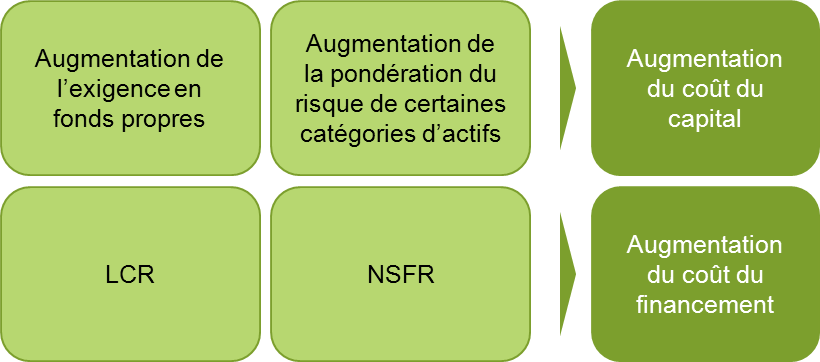

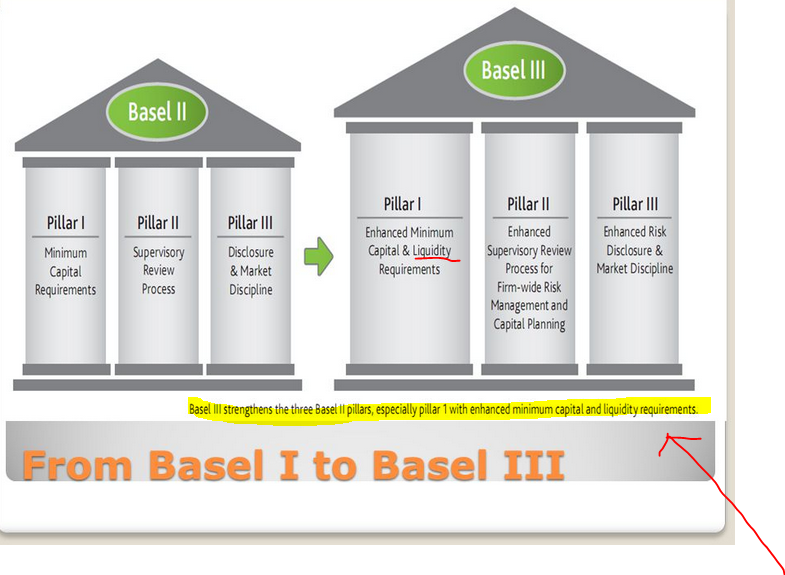

Bâle 3 : les ratios de liquidité vont-ils changer le business model bancaire traditionnel ? - BankObserver - BankObserver

What is the Liquidity Capital Ratio and how did Westpac get it so wrong? | by Damien Minter | Medium